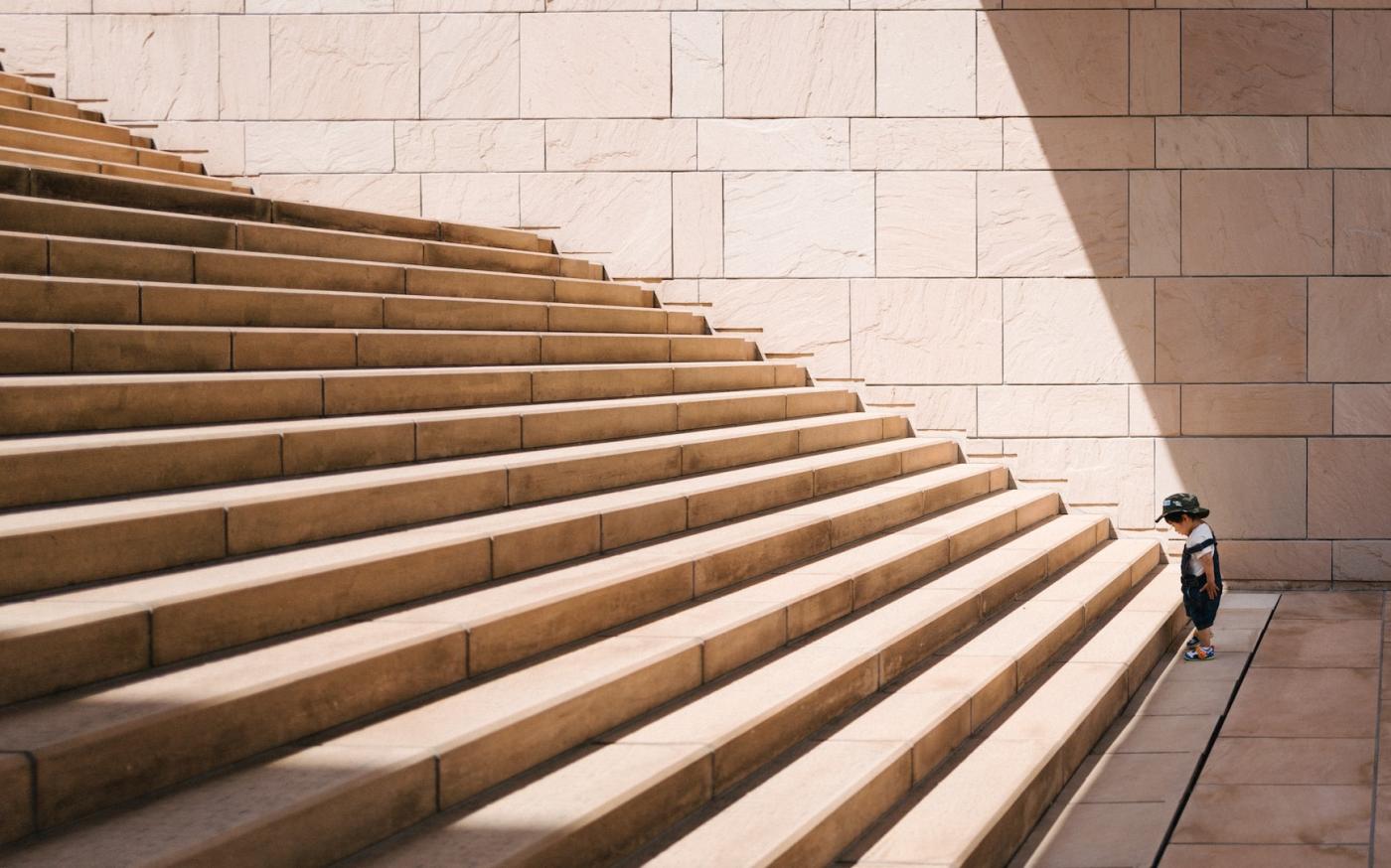

How often do you set new financial goals? How often do you achieve them? Most of us aren’t very successful with our goals, even when we have the best intentions and strong willpower.1 Sometimes, that’s because we’re setting unattainable goals. Other times, we’re missing the big picture and setting our goals with blinders on.

Goal-setting. It's the bread and butter of success across so many domains. But are you only scratching the surface? Dive deeper. A financial professional doesn't just help connect the dots; they can help you reveal additional possibilities you hadn’t even considered! Let's explore why.

In a shocking turn of events, the Supreme Court has halted the presidential student loan forgiveness plan.1 So, where does that leave you and your outstanding student loans? Let's navigate this new financial landscape together.

Would you enjoy your retirement more in the U.S. or abroad?

Are you currently negotiating a new job offer or searching for a new role? This article aims to guide you on your journey. The question is: how do you ensure you receive a salary that mirrors your worth?

Noticing signs of decline in our loved ones is always hard, and making care decisions for them often feels even harder. While it's impossible to make the process entirely painless, the following guidance should be useful on your journey.

Many of us have experienced the cost of financial literacy gaps at one point or another. And if you’re like most folks, the gaps in your financial literacy probably cost you at least $500 last year alone. 1 Think of it as a type of financial illiteracy tax. However, there is good news: you do NOT have to keep paying it year after year. The more you brush up on your financial knowledge, the better...

A gap analysis can help you see if you’re still on track to pursue your financial goals.

Feel overwhelmed by tax documents? Staying organized may help reduce your tax season stress.

There’s no doubt that it feels great to help someone in need through charitable giving. There are more than 1.5 million nonprofit organizations in the United States that range from food banks and disaster relief centers to churches and cultural centers. And in 2018, Americans contributed over 4 billion dollars to charitable organizations. While you may have altruistic reasons for donating to a charity that you support, there can also be tax benefits that come...

If you’re looking to lower your tax liability before the deadline, here are some options to consider.

From retirement savings to living abroad, here are some of our commonly asked questions.